The Bull Case vs. The Bear Case

A bonanza of charts demonstrate the case for higher equities versus the case for lower equities

Last August at the Jackson Hole Symposium of Central Bankers, Federal Reserve Chair Jerome Powell assured millions of viewers that inflation would fall. He said “elevated inflation readings would be temporary”, that any present inflation could be attributed to a “narrow range of goods” that is transitory and won't persist, and that there was enough slack in the labor market to prevent accelerated wage pressures.

Each of those assurances proved to be wrong.

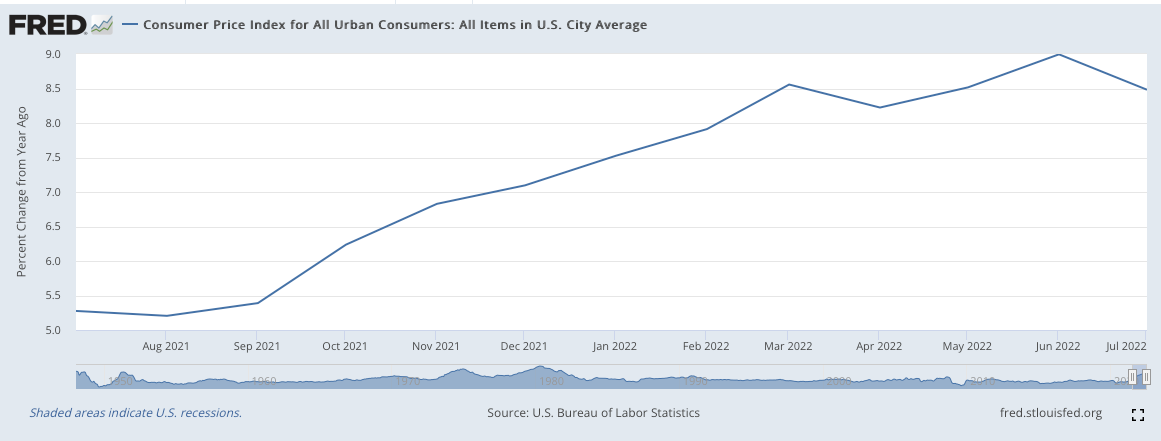

The Consumer Price Index has only moved higher in 12 months:

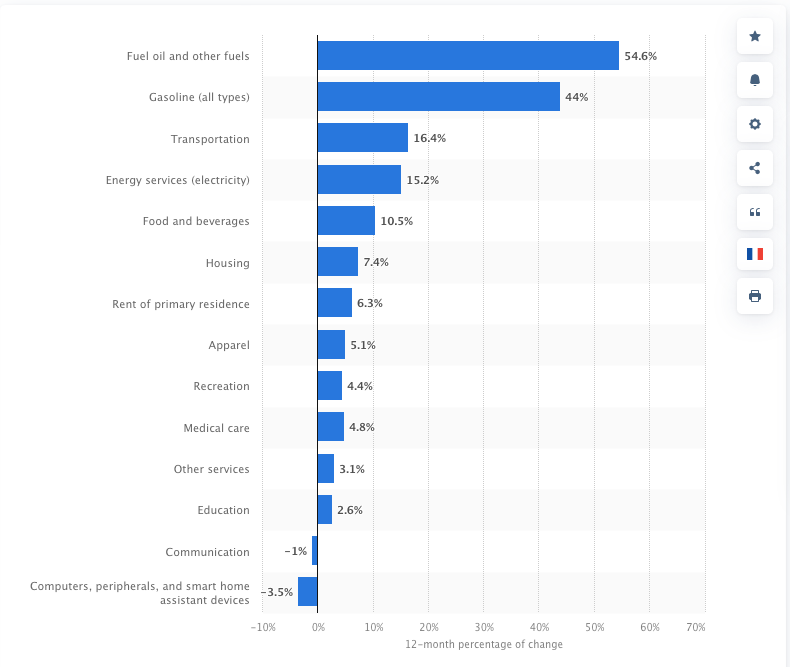

Only inflation in “Communication” & “Computers” is down over a 12-month period:

And the spread between “Job openings” and “Hires” is extreme, indicating a very tight labor market that is putting upward pressure on wages:

And while there is upward pressure on wages, it's not nearly enough to keep pace with inflation. Real Wages remain deeply negative:

It was the outgrowth of this reality that in early 2022 called the Fed to action. Comforting words and reassuring guidance could no longer be relied upon. Since Q1 of this year, the Fed has crammed a series of rate hikes down the throat of the economy and has begun to roll off assets on its balance sheet all towards the end of tightening “Financial Conditions” to reign in inflation. Equity markets and credit markets responded in kind with selloffs of more than 20%.

But now, both the equity and bond markets have recovered a large chunk of the first half’s losses and murmurings of a positively changing outlook are making rounds in the media and in Fintwit.

Is this the beginning of a new bull market in equities? Or will equities breach or retest the June lows?

Below I will lay out the Bull Case and the Bear Case and offer my opinions.

The Bull Case

The bull case is premised on three things:

The belief that inflation has peaked

The belief the underlying economy is not too strong nor too weak

And because of the first two, the hope that the Federal Reserve might reverse the course of its “hawkish” interest rate policy.

Evidence for each of these 3 arguments has become more supportive over the past few weeks.

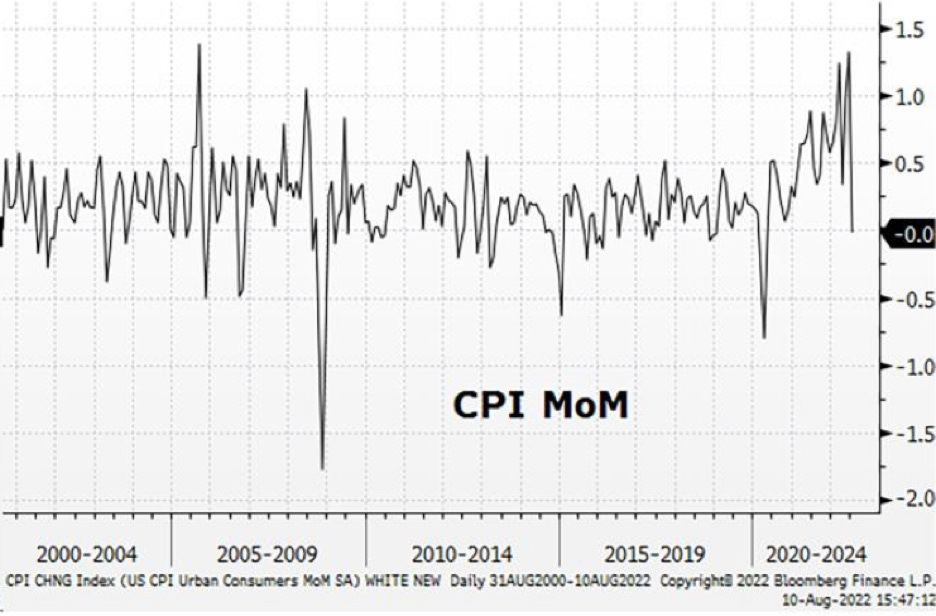

First, the CPI fell MoM in July:

Expectations for inflation in the future are down meaningfully from their April high:

A strong economy paired with rising inflation is not a good thing as it indicates more Federal Reserve tightening. But if inflation is falling and the economy remains robust, that is a scenario amenable to rising stock prices. The evidence for a (relatively) strong economy is that:

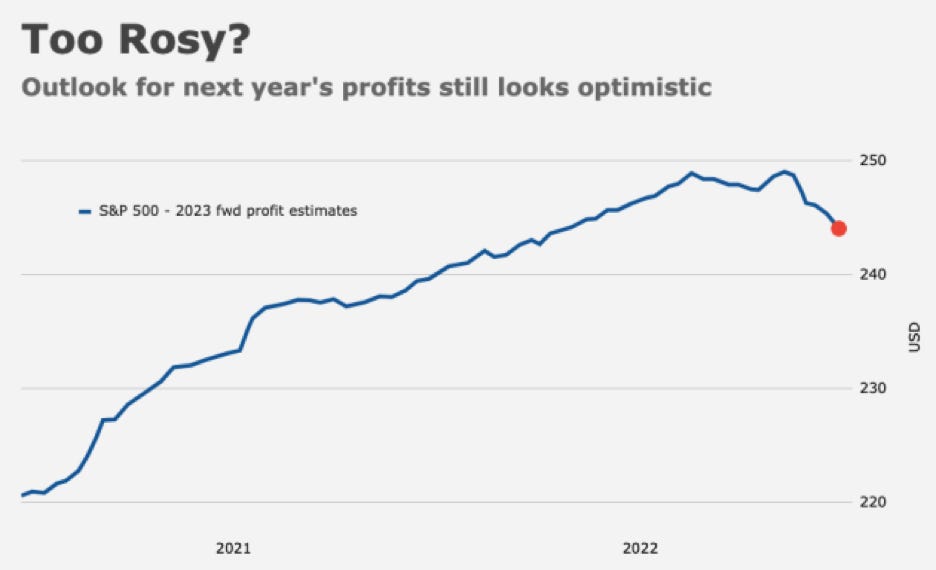

Corporate earnings did not disappoint in Q2 as many analysts expected and the profit outlook for 2023 appears robust:

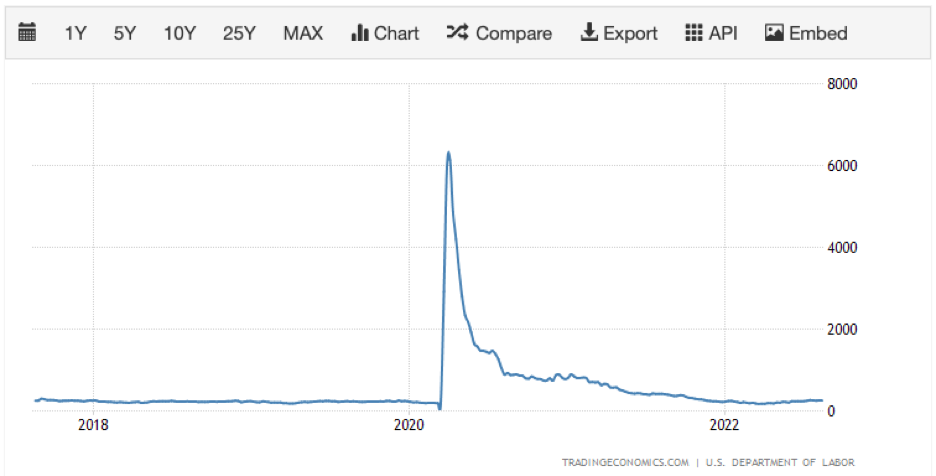

Jobless claims remain at the lower end of a range, indicating a deeper recession might not be in the cards:

The hope that the Federal Reserve might reverse course on interest rates is premised on the first two beliefs which is that inflation has peaked and the economy is in a sort of “Goldilocks” zone. The market began to price in rate cuts in 2023 (though it has since reversed course):

In a word, the Bull Case is a belief that the Fed will achieve a “soft landing”. A “soft landing” is a term that indicates the success of the Federal Reserve in bringing down inflation by tightening monetary policy and doing so without causing a recession.

The Bear Case

The Bear case will prevail in either of two potential outcomes:

The Fed is too successful in fighting inflation and as such inflation falls, but falls so fast that the economy plunges into a deeper recession.

The Fed has not tamed inflation and will continue hiking rates and tightening monetary policy to the detriment of equity valuations.

The idea that inflation might fall so fast that the US economy is plunged into a deeper recession is supported by a number of charts:

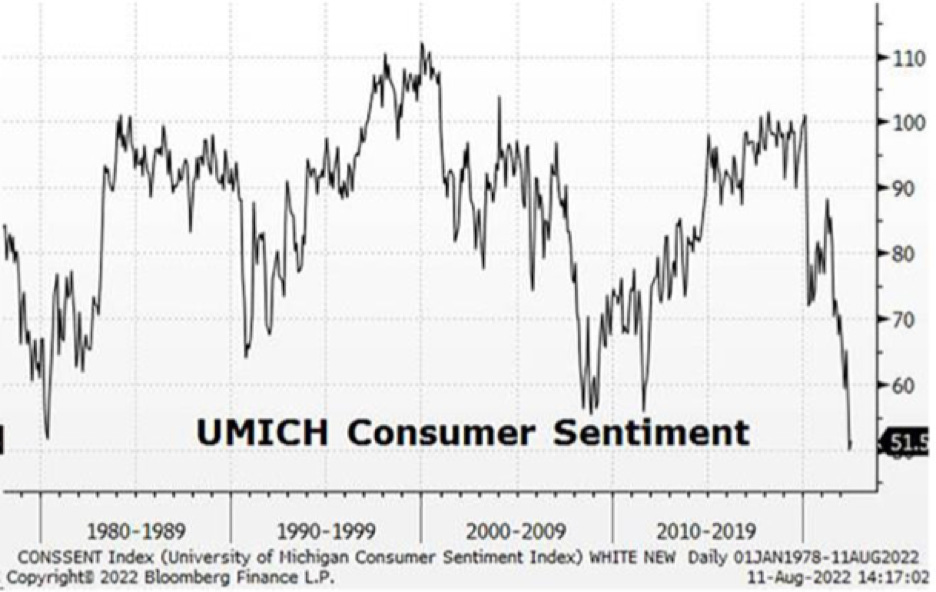

Consumer sentiment has rarely been lower:

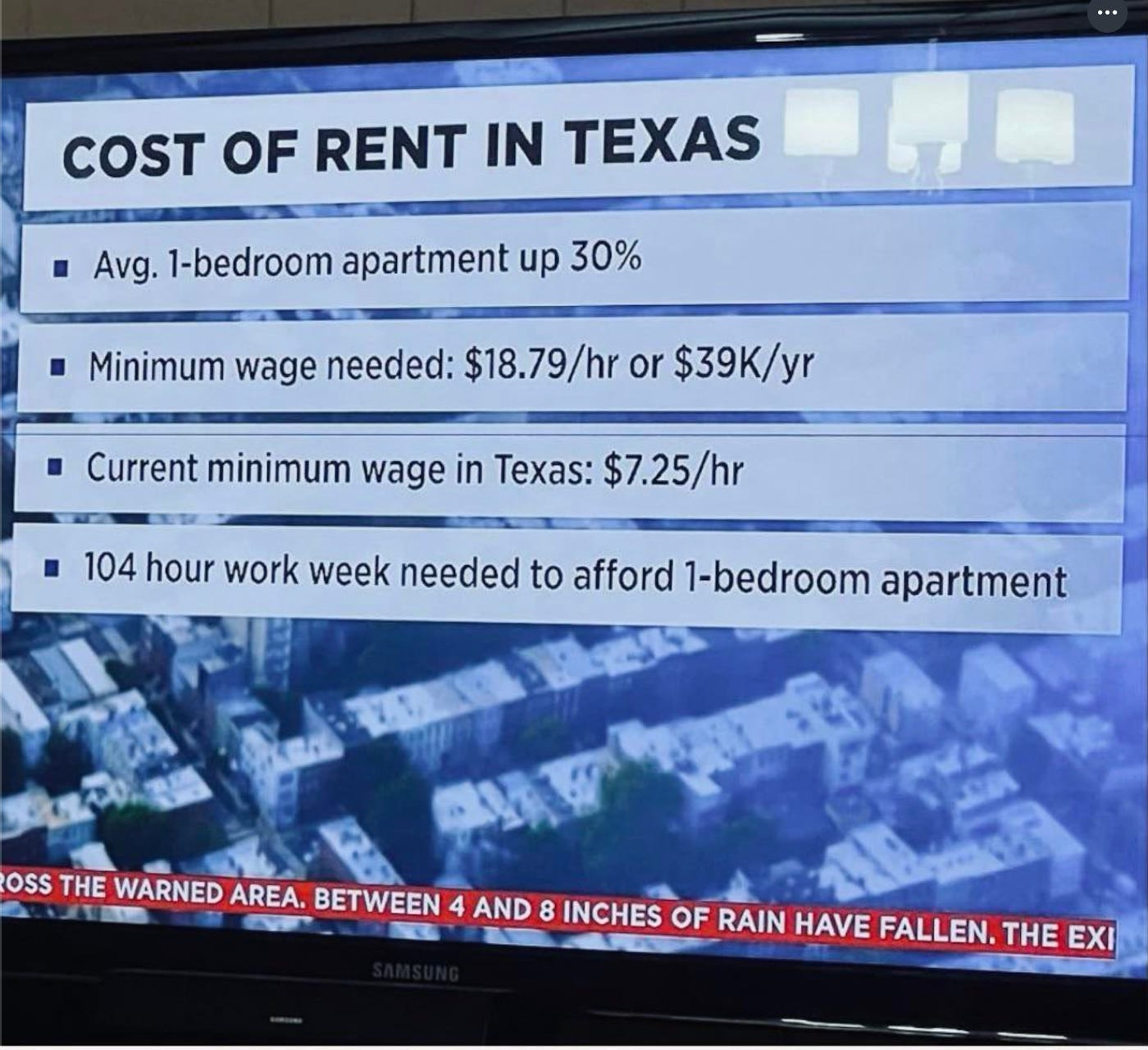

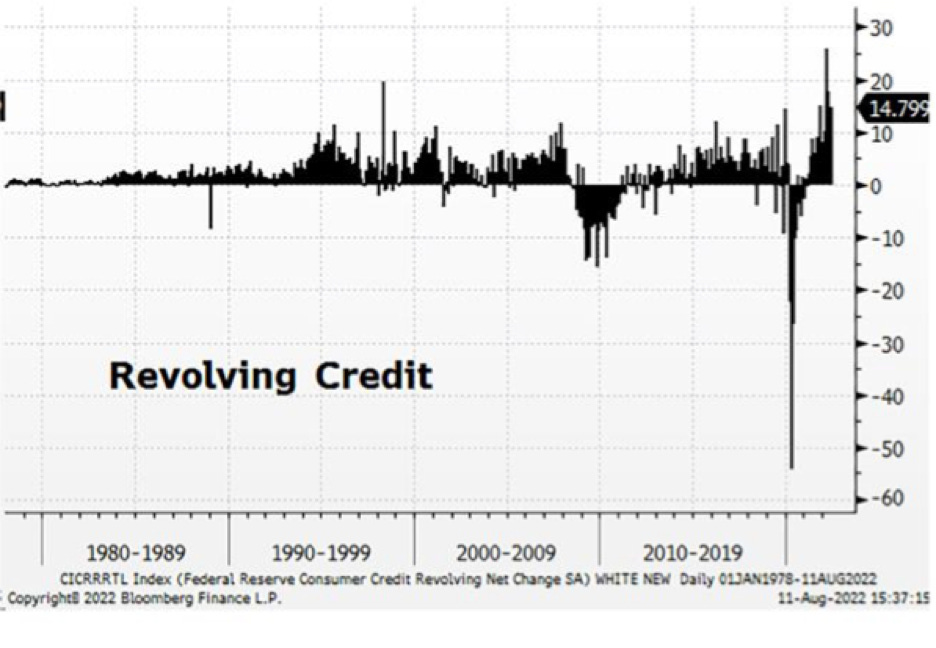

The cost of living is forcing consumers to increase credit card spending, potentially signaling pending demand destruction:

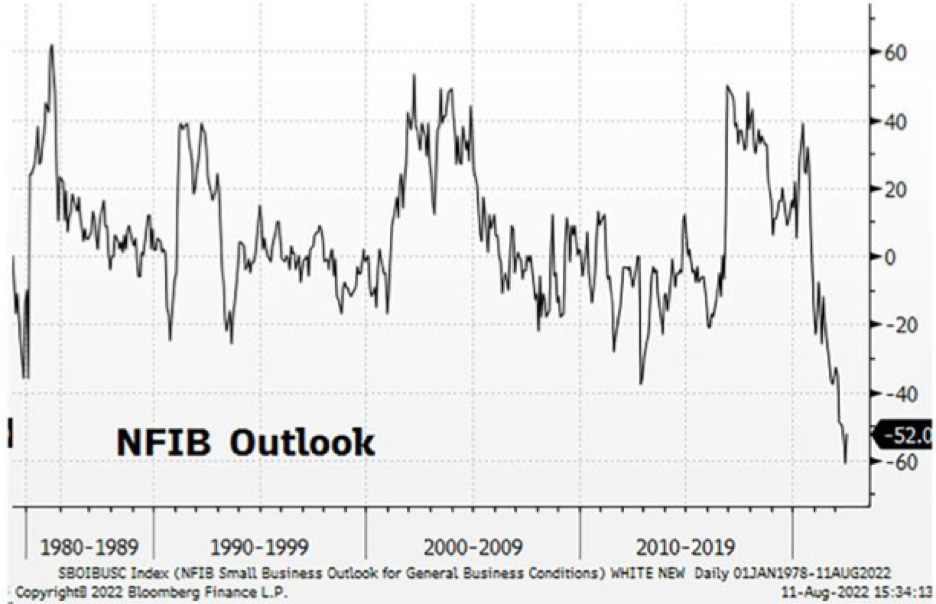

Small Business outlook is the worst in decades:

Wholesale inventories are at extreme levels, which means if demand does falter then prices will need to be slashed to reduce inventory:

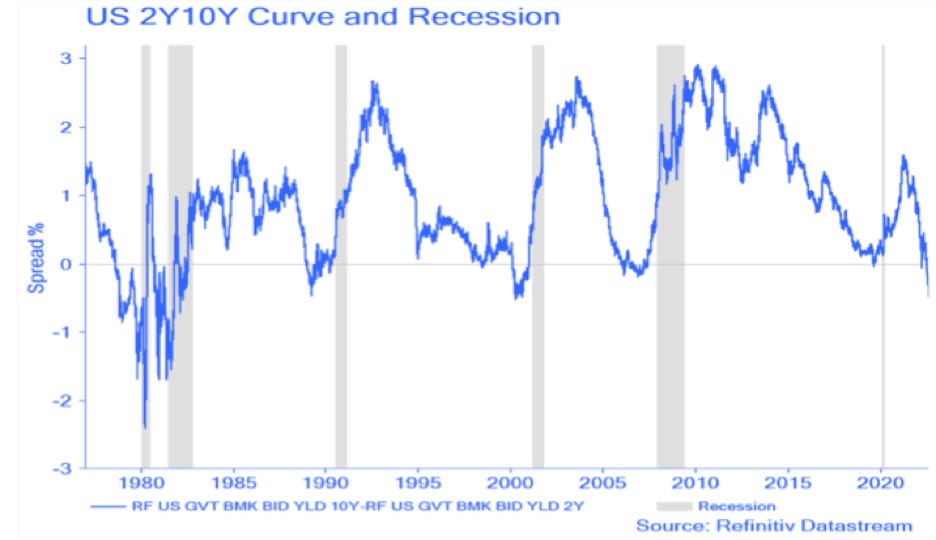

The yield curve is inverted, which has a good track record for predicting a recession that happens as the curve steepens (goes back up) after inversion:

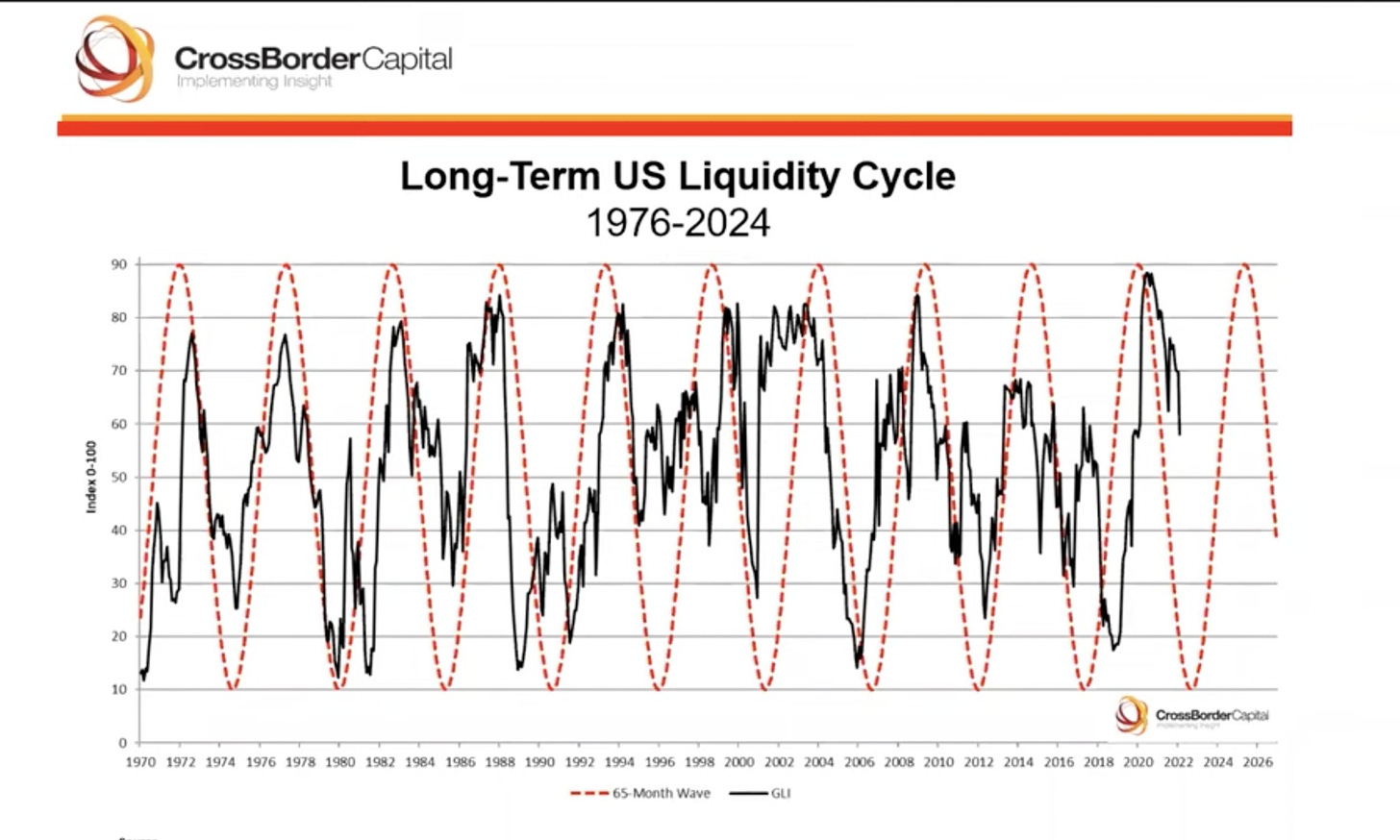

US Liquidity conditions are getting tighter:

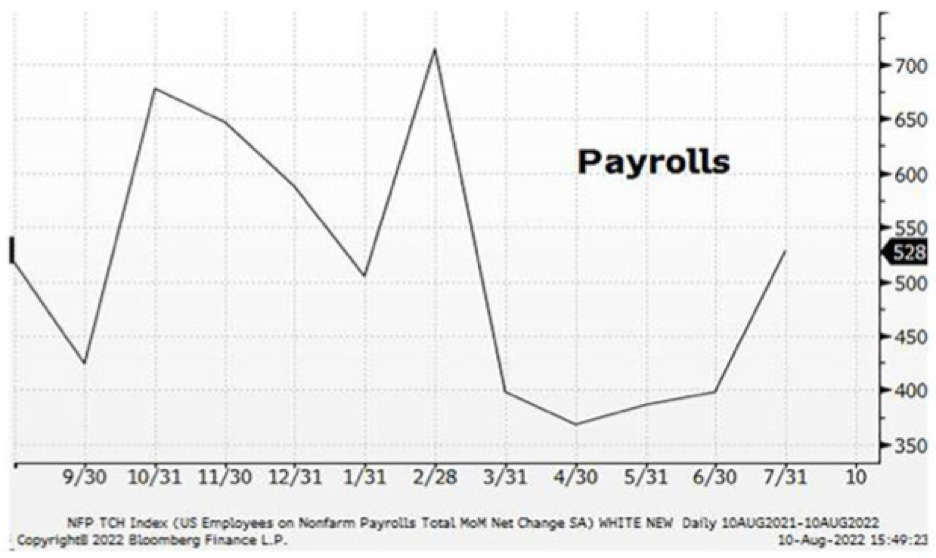

While all of the above suggest the economy is slowing and slowing fast, the idea that inflation might not be tamed and the economy might still have legs is primarily supported by the strength of the job market. Unemployment is low, jobless claims are low, and the number of month-over-month payroll gains is actually climbing. If demand remains intact and the job market strong, equity markets can expect more hikes and more tightening:

If this seems confusing, its because it is. I do not recall a time since I've been studying markets where the economic outlook was so murky.

My takeaway is that we are not yet out of the inflationary woods just yet. The job market remains robust and so long as it remains so, demand destruction will be muted. As such, the Fed will continue to tighten monetary conditions and this will serve as a headwind to equity valuations.

Much will be learned next week as the Federal Reserve meets in Jackson Hole for its annual meeting of central bankers. Once again, all eyes and ears will be on the speech by Chair Powell. Regardless of whether you're a bull and hope that he signals a pivot in policy, or a bear and think more tightening is needed, it will be incumbent on Powell to make a convincing argument in one direction or another. Otherwise, the Fed’s credibility hangs in the balance.

The Market Rundown in Charts:

The Euro is again testing parity versus the dollar (1 EUR= 1 USD). This indicates a strengthing dollar, which tightens financial conditions in the global economy:

Bitcoin appears to have failed in breaking higher. Much of this year’s selloff in tech stocks has been presaged by a selloff in crypto:

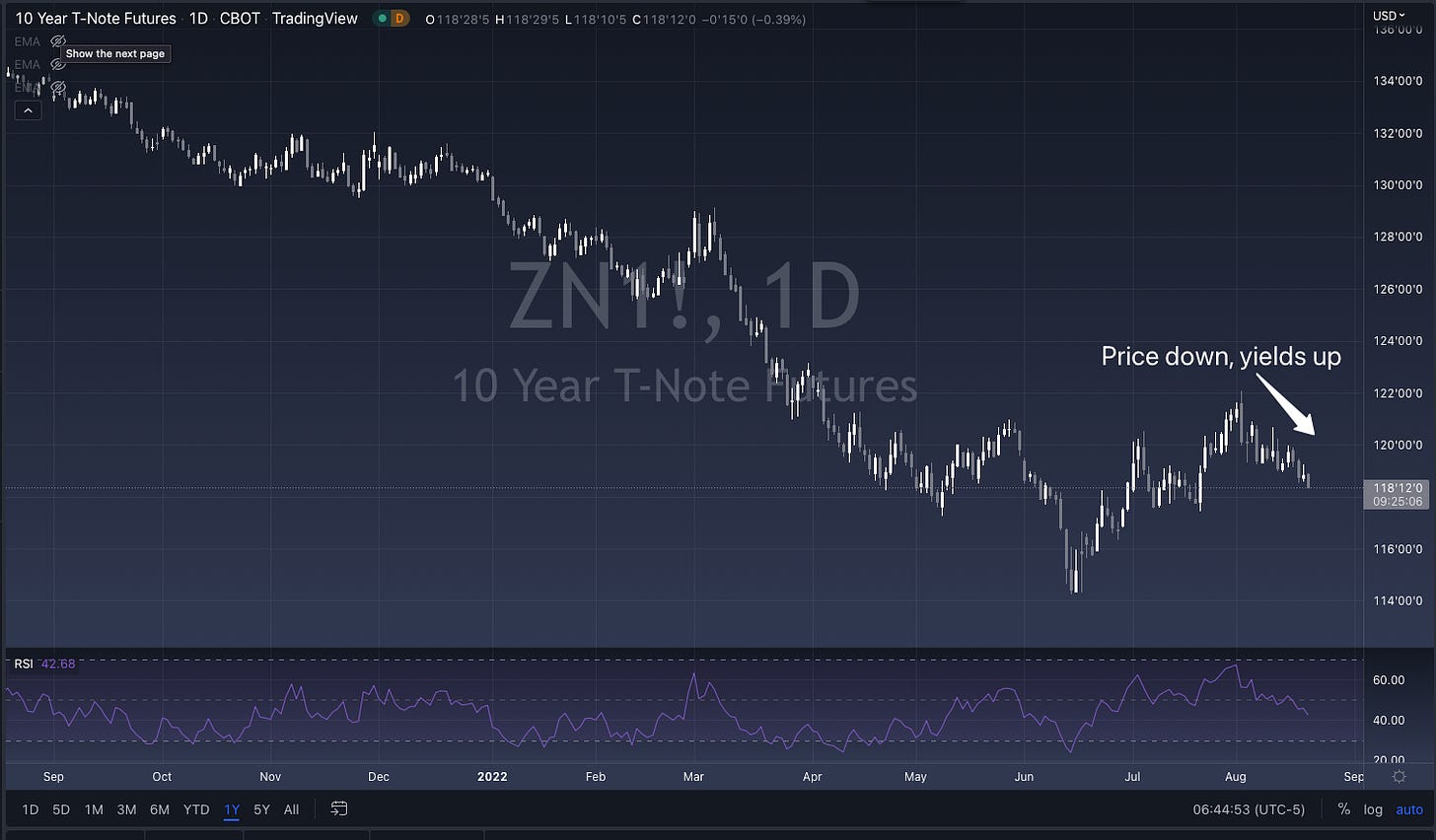

Bond bulls may have jumped the gun on calling for a recession as it appears bond price down, yields up is resuming its prior trend:

Have a nice weekend.