Belaboring the Point of The Labor Market

Why the job market is so significant to The Fed's outlook on monetary policy

If you’ve been reading the last few editions of TMR, you might have found yourself perplexed at the thought that members to a governing body, who so often campaign on the promise to create “more jobs”, might occassionally act to destroy them.

The premise underlying the motivation of the Federal Reserve to “crush the job market” is well regarded but often disputed. That premise is that the swiftest, most practical manner to reign in inflation is to subdue demand. Demand for goods, services, and labor. If demand falls, the theory goes, the prices of goods, services, and labor should fall too as companies cease hiring and slash prices in effort to retain market share.

Economists and practitioners who dispute this premise do so in favor of pursuing the opposite to reign in inflation, which is to expand supply. Since inflation is essentially an imbalance of supply and demand, the choice between expanding supply and crushing demand, contrarian economists would say, should be appropriated to that which causes less harm on the health and well being of the country and its working population.

The problem is that the government, especially the Federal Reserve, does not have the ability to increase supply, i.e. increase production. In a free market, the government has no control over whether or not a company chooses to invest in property, plant, and equipment. And a business will only do so if they are forced to through competition or compelled to by a sustained increase in demand for their goods or service. On the contrary, the Federal Reserve has what is often referred to as a “blunt tool”, which is the ability to control the price of money and the degree to which money expands or contracts in the real economy.

Stuck between a rock and a hard place, the Federal Reserve, it seems, has no alternative but to hike rates to the moon in an effort to crush demand and bring into balance the opposing forces of supply and demand.

To better grasp the framework Fed Economists operate under, its important to understand the effect the labor market has on inflation.

The price of labor is beholden to the same laws which determine the price of any good or service. That law being the law of supply and demand. If supply is constant and demand for a good rises, the price of that good goes up. If demand is constant and supply increases, the prices of a good goes down. The same is true of labor. If the demand for labor exceeds the supply of labor, the price of labor, i.e. the wage, goes up.

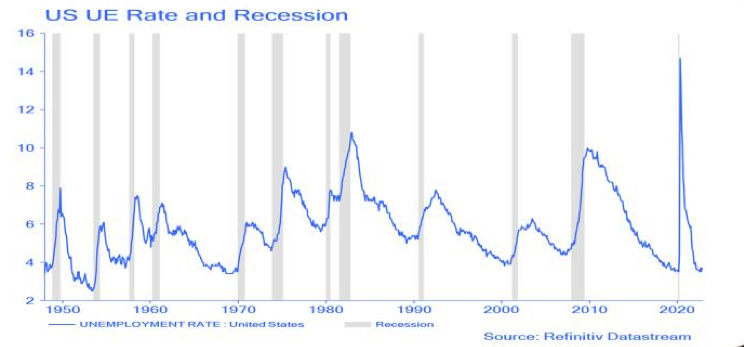

Conventional wisdom, or the wisdom of establishment economists, hold that the supply is best captured (if not imperfectly) by the unemployment rate. Right now, the unemployment rate is near all time lows:

Taken at face value this chart suggests that the overwhelming majority of Americans are employed. Maximum employment translates to maximum income which means maximum spending. Further, it means that the labor market is more competetitve. It means that if I want to hire a Joe and you want to hire a Joe and the other guy wants to hire a Joe well we all must compete for the Joe. We compete by increasing Joe’s wage. As Joe’s wage rises, other Joes might take notice and want the same increase.

This example is best exemplified in a manufacturing environment where companies offer higher wages to attract new employees and the existing employees take notice and demand the same wage increase. Suddenly, the total cost of labor for a company rises, perhaps not insignificantly. And that company makes up for the margin cut by increasing prices to end users. This creates inflation.

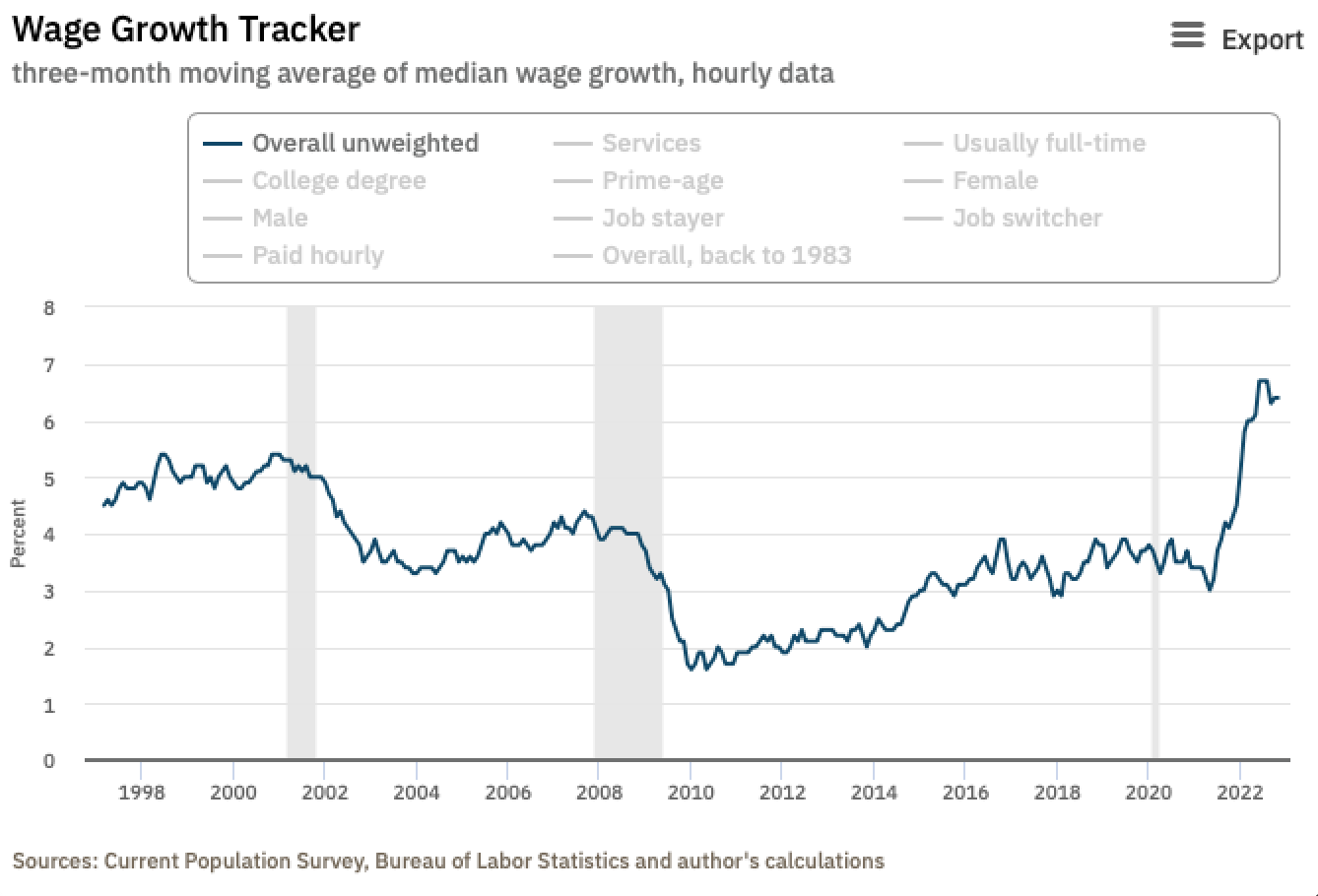

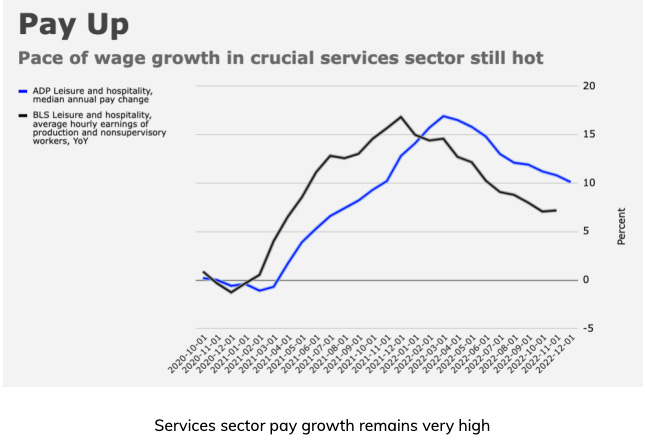

As you would expect in a “tight labor market” enviroment, nominal wages are rising.

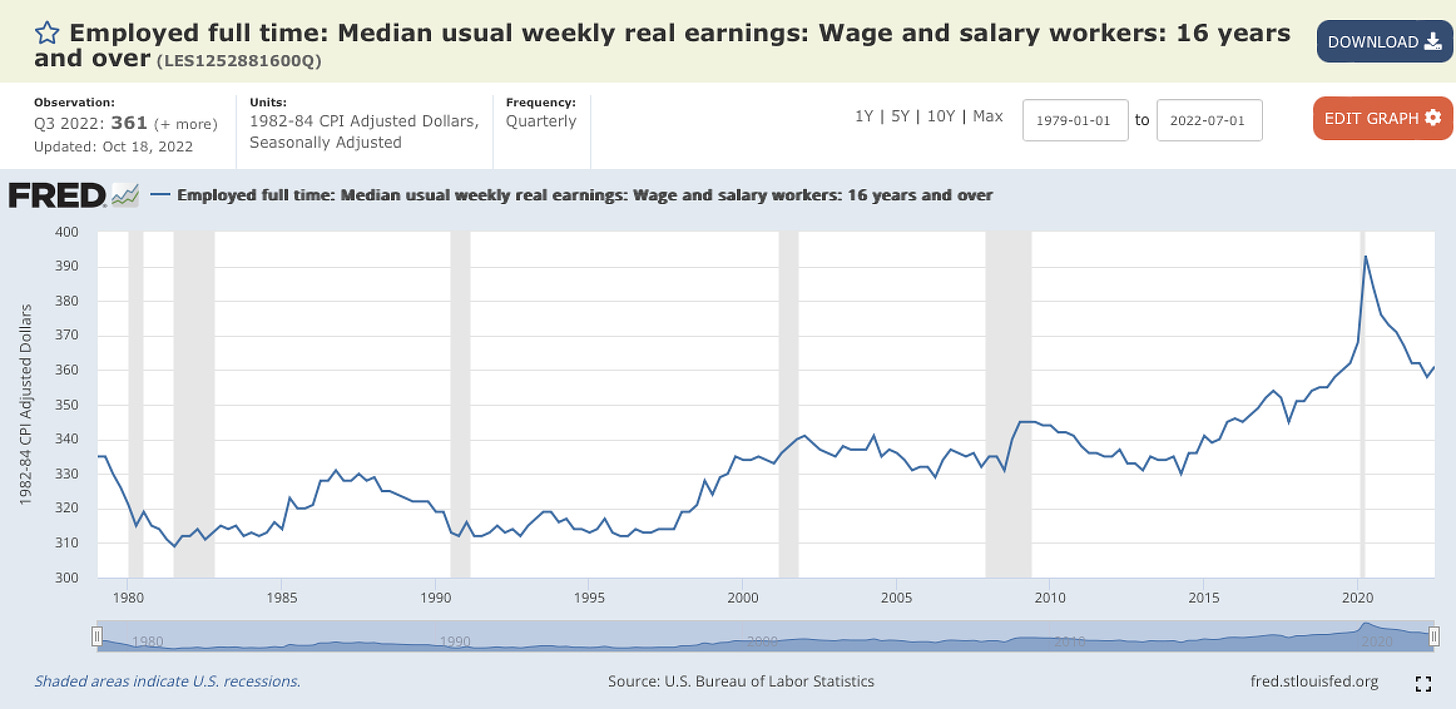

But “Real wages”, or wages after factoring in inflation, are falling:

Put simply, thats because inflation is outpacing wage gains. Why is that?

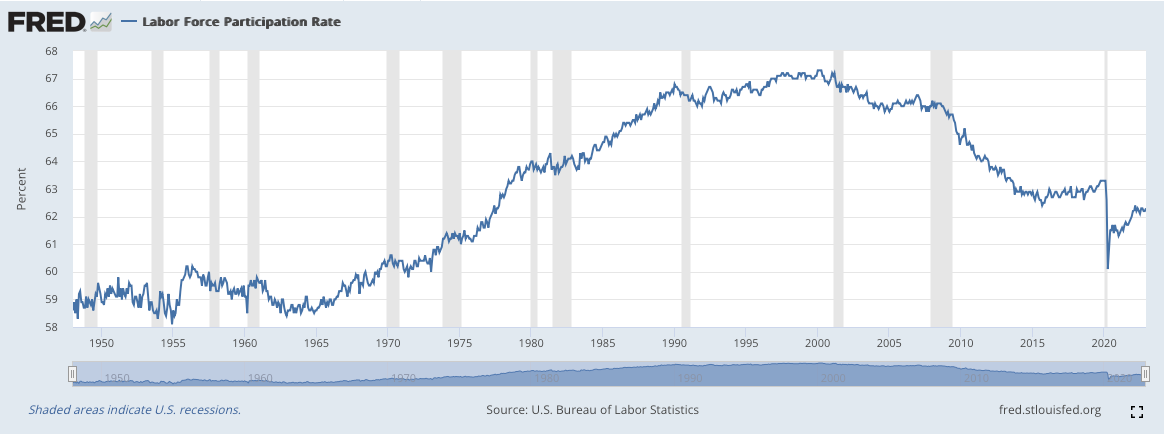

Part of it has to do with the composition of the unemployment rate. The unemployment rate is not a function of the total domestic population and the percentage of people employed. It is a function of the “the labor force participation rate”. The “labor force participation rate” consitutes anyone who has a job or is looking for a job. A person is not included in the labor force—and as such not included in the unemployment rate—if said person is retired or is not looking for a job.

Here’s a look at the “Labor Force Participation Rate” in the U.S.:

As you can see only 62% of the U.S. population “has a job or is looking for a job”. 38% of the population, or roughly 125 million people, are not looking for jobs.

The point in highlighting this is that their exists some “slack” in the labor market. Many participants in the labor market are transitory, and as they come and go the supply of labor grows and shrinks. This calls into question the supposed “strength of the labor market”. Combined with the deflationary effects of automation and advanced technology, the “labor market” becomes even more an amorphous concept. The transient nature of the labor market might explain why real wages are depressed.

But enough with waxing philosophical. What matters for markets is the Federal Reserve’s expedition to slow inflation.

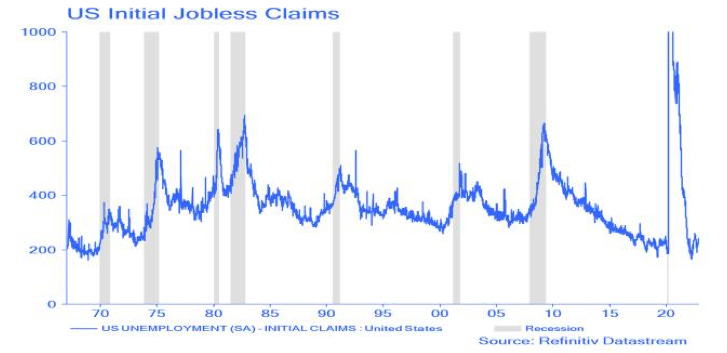

Recessions are deflationary and a spiking unemployment rate often precedes recessions. The Fed wants deflation, ergo they want a recession (albeit a mild one). Heres a look showing the correlation between a spiking unemployment rate and recessions:

The first tell on rising unemployment rate is a rise in Jobless Claims. As you can see not many people are claiming with the government to have lost their jobs:

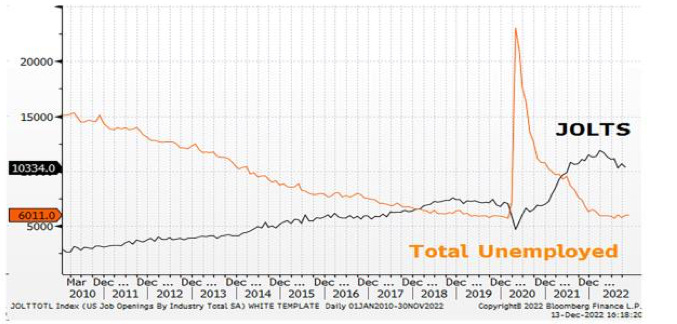

One way to get a read on weather or not jobless claims might rise is to take account of the number of jobs openings. If there arent many jobs on offer, then its more difficult for a worker laid off to find a new job. On the contrary, if there are a lot of job openings, you’d expect anyone laid off to easily land a new job elsewhere. Here a look at job openings vs the total number of people unemployed:

As you can see, there are far more job openings than there are people unemployed. This suggests the Fed has a ways to go.

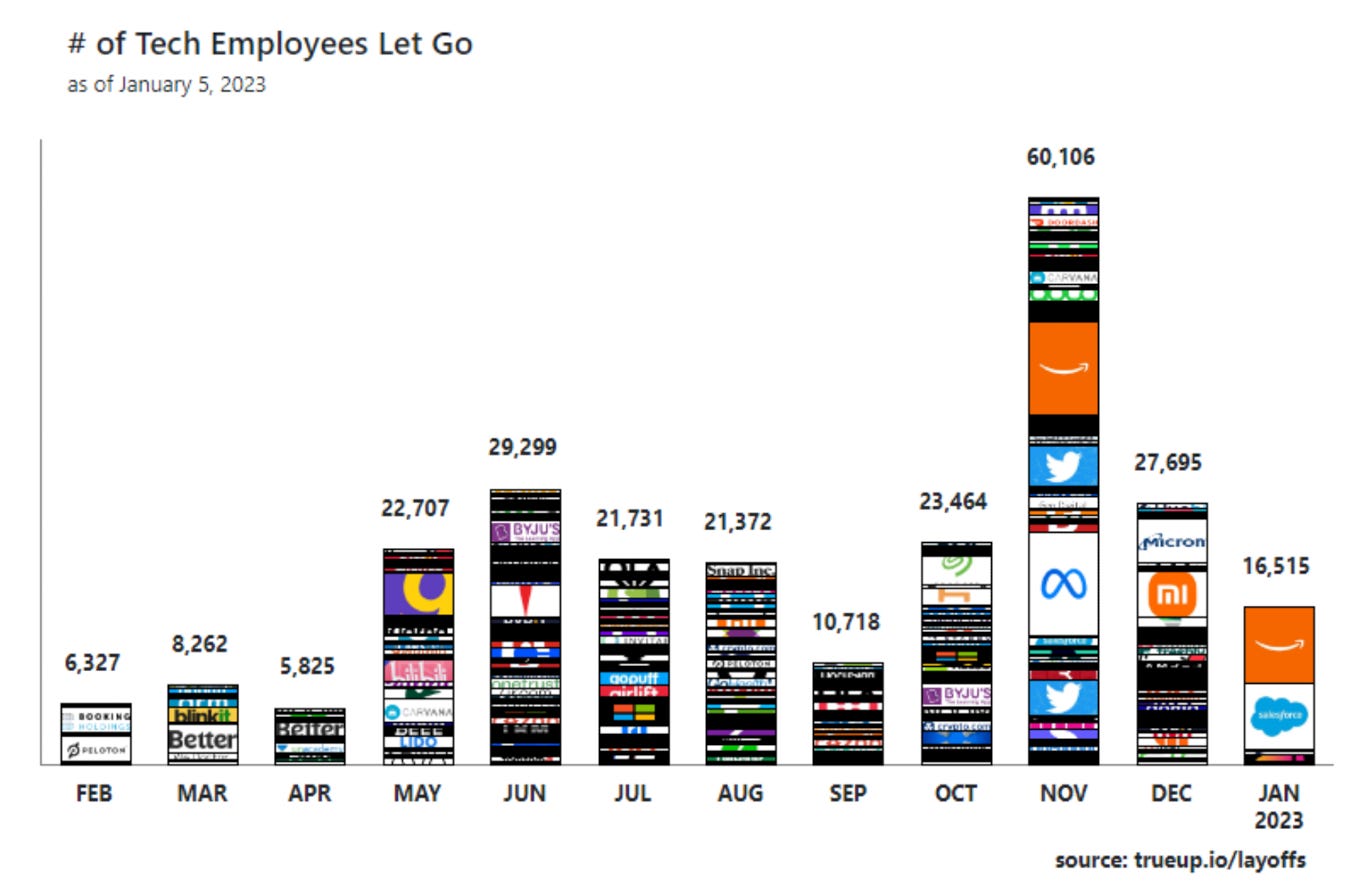

That said, anyone whose paid attention to labor market related news lately wont be surpised that the number of “job cuts” is actually rising:

But the industries where these “job cuts” are occuring is confined to the “Technology Sector”, mainly in the coastal states, like NY and CA:

In fact, the data from December for private employers beat expectations as private employers added more jobs than expected:

Breaking it down by sector, construction was the only part of the goods sector that added jobs, adding 14,000. On the services side, leisure and hospitality led the way adding 123,000 jobs.

Indeed, it is the services sector which remains most resilient and which continues to experience increases in wages. Wage growth in the services sector remained in double digits last month:

In summary, the labor market is still too hot for the Fed’s liking. Just this morning, the unemployment rate fell to 3.5%, and the economy, according to Non-Farm Payrolls, added more jobs (223,000) than what was expected (200,000). Jobless claims have not risen materially, and job openings remain elevated. If the Fed wants to engineer a drastic slowdown in the labor market, it seems they might have further to go in terms of restrictive monetary policy.

Moving forward, the size of Federal Reserve rate hikes is an open question. So too is the terminal rate, or the destination they are trying to get to before ceasing with the rate hikes. What seems to be a question with a clear answer is the question of a “pivot” in policy. Thats not happening any time soon. Unless something in the capital markets becomes unhinged and experiences a cascading liquidation, monetary policy will remain restrictive for longer.

The Market Rundown in Charts

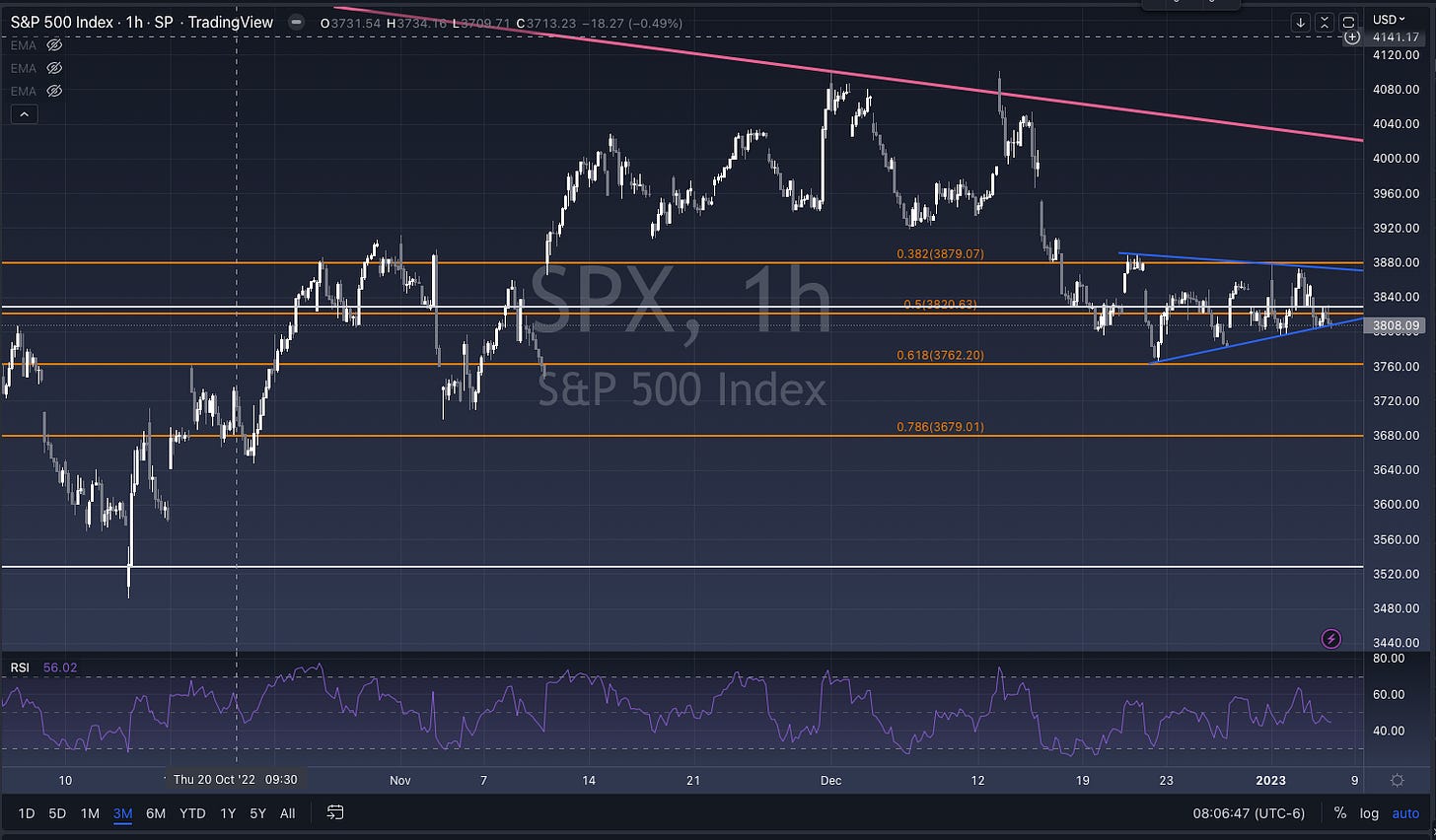

The S&P has been range bound for almost a month now. Where we go next is anyones guess, but too much higher wont last for too long, I dont think:

Tech darling “TSLA” has fallen off a cliff and looks like the only way forward is down:

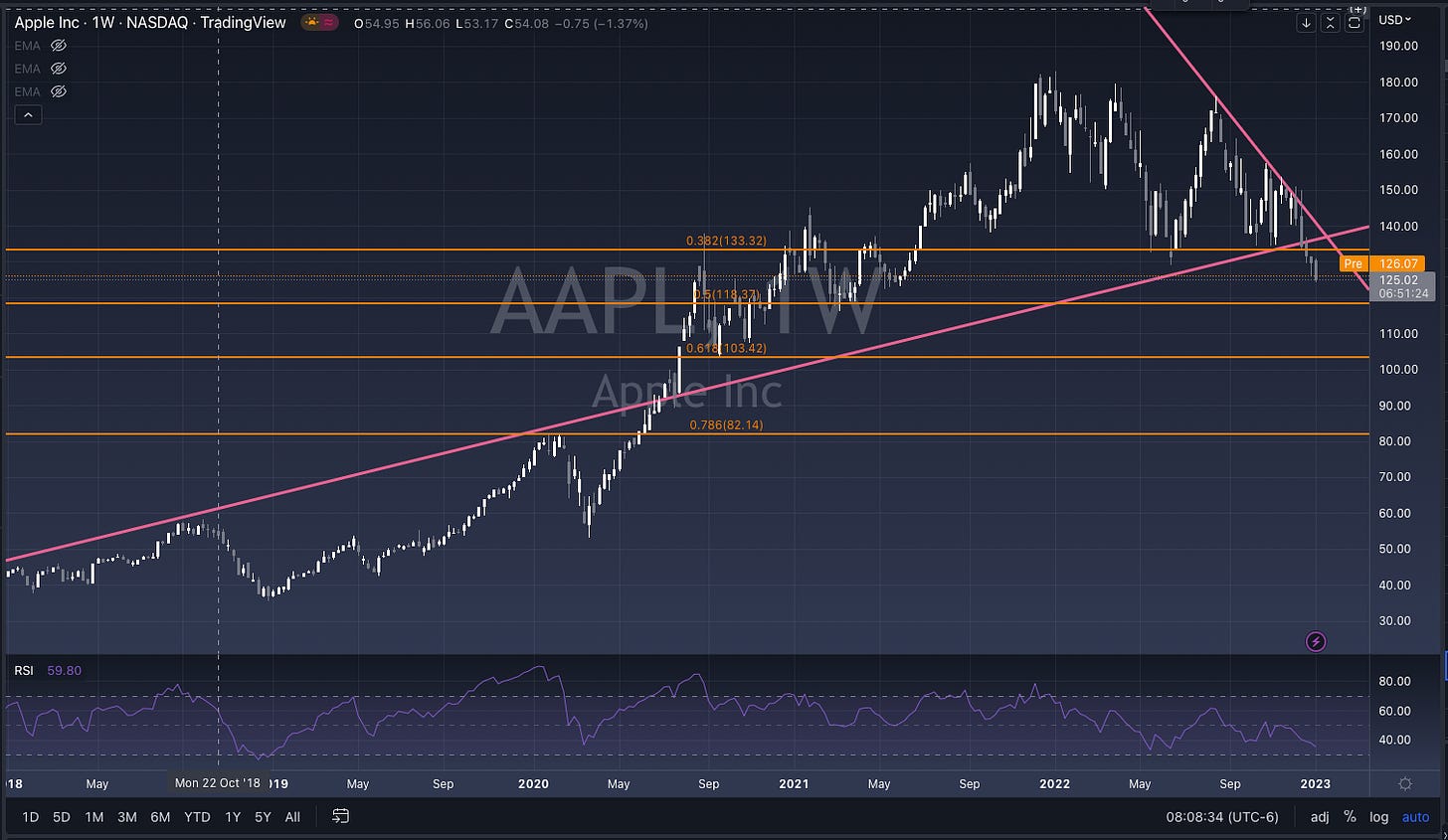

If Apple follows Tesla, the broader equity markets will follow Apple:

Thanks for reading and have a nice weekend!